Finance

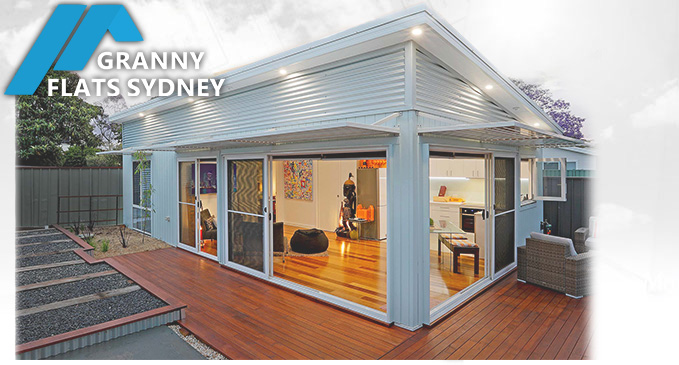

Obtaining finance for your granny flat

Granny Flat Approvals have partnered with Choice Home Loans, They are national innovators in providing mortgage services and creating home loan solutions for people around Australia. Choice Home Loans have won multiple Australian Mortgage awards because of their commitment to excellent customer service, professionalism, reliability, integrity and for having the most positive impact on the industry as a whole.

Simon Pak Poy has over 12 years experience in the financial industry and can assist you obtain the right finance package for your individual circumstances. Simon will listen to your needs and help you choose the loan that suits you best, he will explain all about mortgage reduction strategies, how to achieve a low interest payment and how you can reduce or eliminate fees.

The two common ways to financing new granny flat builds:

- Use the current equity available in the property on which the granny flat is to be constructed.

- Utilize a construction loan to build your granny flat

One of the key pieces of information that will assist you in getting appropriate finance options for your circumstances will be the BANK VALUATION amount for the existing property.

Choice can provide you with an automated Valuation Report from RP DATA, this should be your first step in establishing the best way to proceed in financing your granny flat build.

The Valuation report will compare your property with the state of the current market and establish the likely bank valuation amount. A number of our lenders use similar data to establish the property’s value.

Utilize the existing equity of your property

Often you are able to utilize the equity available in the property to fund the construction of the Granny flat. This can be way of an additional loan “ added” to your current home/investment loan or a new equity facility can be provided allowing you to pay the builder at each stage of construction and minimize interest charges during the construction process.

The construction of a Granny flat provides the customer with a great opportunity to review their current mortgage arrangements and either remain with that Lender or possibly refinance to another Lender with more favorable terms and rates.

Obtain a construction loan

Construction loans will be approved based on generally the value of the existing property and the value of the Granny flat build.

In addition to the normal bank requirements there are two further requirements which must be supplied to the Lender they are:

- Signed contract with the builder

- Council Approved Plans and Specifications

3 ways to get started:

Make An General Enquiry or Request An Appointment

Request Valuation Report

Receive 24 Page Home Buyers Guide

For more information:

Choice Home Loans

Simon Pak Poy

Credit Representative Number 399562 under Licensee BLSSA Pty Ltd ACN 117651760 (“BLSSA”)

Australian Credit License Number: 391237

0414 069 551

spakpoy@chl.net.au

PO BOX 7039 BONDI BEACH NSW 2026