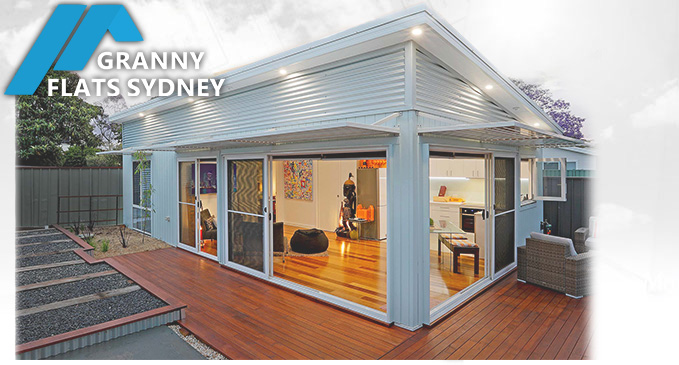

Australian Granny Flat Rentals – Additional Income for Investors

Granny Flat Rentals as Additional Income for Australians- Mathematics for Investors

Since 2009, Australian Governments have begun supporting Granny Flats via their new planning policies. The NSW policy is termed the ‘Affordable Rental Housing- State Environmental Planning Policy (SEPP)‘. The State Government is encouraging both home-owners and investors to build new secondary dwellings because, to put it bluntly, Sydney is full. This is why granny flat rentals are on the rise.

Not only property investors but home owners are now seeing the huge benefit of earning a significant income from granny flats in their existing property’s back yard. Here at Granny Flats Sydney, we are seeing secondary dwellings being rented-out even before they are fully built. This is not only limited to Sydney but includes regions such as Newcastle and Wollongong not to mention Country NSW, where the demand for accommodating mining workers is at a critical point.

The added attraction to this new legislation is that in most cases, it supersedes your Local Council’s policy on secondary dwellings, making granny flats much faster and easier to build. It’s easier because you don’t need Council approval- instead you can apply to a Private Certifier and it’s also faster because the approval can be granted in just 10 days by a Private Certifier.

But what of the raw benefits, particularly for investors? What are the risks and what do the raw mathematics say about granny flats as an investment? Can a new secondary dwelling help reduce your mortgage term and can it be a real source of income for investors. How much better are granny flats as an investment compared to, say, shares or bank bonds?

Lets firstly take a look at the costs of building a new granny flat. An average price today for a quality-built, brick-veneer granny flat in Sydney is around $100,000. You can secure finance as a re-draw on your property’s equity or you can secure finance under a construction loan. The process for securing finance is detailed in a post we authored: https://www.grannyflatapprovals.com.au/news/securing-a-granny-flat-construction-loan/

Lets say you completed the build in 2 months and immediately began earning rental income from your new granny flat (termed a ‘secondary dwelling’). Lets take an average suburb, say Parramatta, where rental returns for a two bedroom, quality-built granny flat are around $400 per week (August 2012). Your rental income is $20,000 per annum. Remembering that the cost to build the granny flat is $100,000, we can realistically say that the rental income will equal the initial investment (minus the interest) in 5 years. This means that within a maximum of six years, you can recoup your entire building investment, compensating for any occupancy rates and interest payments.

After this time, all income earned from the granny flat ($20,000 per annum) is pure profit and is 100% cash-flow, or a 100% ROI (Return on Investment). So $400 weekly income is achieved from an initial investment of $100,000 borrowed on the value of the property. The value of the property is also increased by an amount equal to an average of 80% of the investment.This is an assumption based on the limited data coming in for granny flats in Sydney at the time of writing this. The data is limited at this time due to the short time-span since granny flats have become a popular investment in Sydney.

As an alternative, what if we borrowed $100,000 and placed it in blue-chip shares for 6 years? What would the return be like compared to investing in a granny flat?

Using the ‘investment rule of 72’ which is a famous shortcut for calculating how long it will take for a share investment to double its growth, a share portfolio should double itself every nine years. So how does that compare to granny flats:

Granny Flat Income per Annum = $20,000

Time to double $100,000 investment = $100,000 / $20,000 = 5 years.

Hence, a Granny Flat investment will double itself every 5 years whilst an identical share investment will take 9 years to double itself. Property is also a safer and more reliable investment strategy compared to shares, although blue-chip shares are considered to be an almost guaranteed safe-bet for investors.

The mathematics tells us that investing in a granny flat, whether it’s on your existing principle residence or an investment property is a better investment strategy than share-trading and has the added benefit of of being tax deductible for investors. If the principle dwelling is purely an investment property, the granny flat project can also be used to reduce the term of the principal dwelling’s loan.

Just how much time can be reduced on the principle loan this way? Lets say the principle dwelling (and property) cost us $600,000 and that we built the granny flat immediately after purchasing the property. If we borrowed 90% of the property’s value, we’d be owing $540,000 on the day after settlement. To pay off the principle plus interest over 25 years, we’d be making minimum repayments of $3,156 per month, or $730 per week, The rental income from both the granny flat AND the principle dwelling is in the order of $900 per week.

It’s also noteworthy to add here that adding a secondary dwelling to the property has positively geared the property.

Repayments at $900 per week will reduce the term of the loan from 25 years down to 16 years- and this is assuming the rental income won’t change for 16 years- which is impossible. Using the standard inflation marker of 5%, we can calculate that the rental return will further reduce the term of the loan, to around 13 years. So a loan for an investment property can be reduced by nearly half, just by adding a granny flat in the rear yard and at no real cost to the developer, since the property will be positively levied (or geared) against the investment loan.

To summarise (in approximate terms) the figures show us that granny flats are a very popular choice for smart property investors, since granny flats are a proven way to maximise rental returns whilst minimising risk. Secondary dwellings enhance a real estate investors portfolio by reducing their loan-term and simultaneously reducing the investor’s personal loan repayments. Granny flat developments in Sydney have seen an asymptotic (or accelerated) growth since 2009 due to the introduction of the ‘The SEPP’ and an increased demand for affordable rental housing in NSW. Smart investors are increasingly recognising the rewards that these developments can bring to an individual investment portfolio.

We hope this article has helped highlight the benefits of building a granny flat either on your own existing property, effectively turning it into a cash-rich investment portfolio; or as an addition to an existing rental property, effectively reducing your loan term and increasing your long term rental income- providing a continuing dividend above and beyond your loan term. We have investors who are buying their 3rd and 4th property and securing their granny flat approvals during the settlement period so that we can begin their granny flat construction as close to the settlement date as possible…

We hope you enjoyed finding out about how investing in secondary dwellings compares to other investment strategies and how granny flats have been facilitated by the NSW Goverment’s new Legislation. We invite you to read our other granny flat articles and news posts on granny flat approvals, designs and building tips for home-owners and investors alike.

Regards,

Serge Panayi- Granny Flats Sydney.

www.grannyflatapprovals.com.au