Protecting Your Investment – Granny Flat Strategies

Protecting Your Investment – Granny Flat Strategies That Work

Protecting your property investment against interest rate rises and property slumps is not an easy thing to do. This is especially true in today’s over-leveraged investment crowd. More and more investors are turning to Sydney’s property boom for maximising their capital growth. Whilst that in itself is not a bad thing, there are palpable risks involved.

Some Sydney Property Figures

To give you an example, lets take a $1M property purchase, which is not a shock-price in today’s Sydney property market. An investor will usually borrow 100% of the value as an offset from either their PPOS or another property. The weekly mortgage repayments are currently at 5% (interest only) which requires a repayment of around $960 per week. As of October 2014, rental income averages around $660 per week in Sydney. And this is where the risk lays. Under our example, you’re now $300 in debt every week, not accounting for other property costs and fees.

The Importance Of Interest rates

Interest rates are at a record low of 5% but as the RBA warns, this can’t go on forever. Interest rates will rise! In 1987, interest rates reached 15.5%, which is a very scary number. Whilst this level of rise is unlikely in the short term, we can deduce that a rise of 2% or so over the next few years is certainly possible, if not likely. A 7% interest rate will increase those repayments to around $1,300 per week., which is an additional $350 per week! Now that is a scary scenario! I should say that the leveraging risk is even greater as you duplicate your purchases.

Capital Growth

Capital growth has rarely been higher in Sydney, with some suburbs boasting 2% per month. This of course is fantastic news for all of us who own investment properties! But what happens to your property investment if growth stops, especially just after a new purchase? What if we see some reductions, which is certainly possible. Whilst no-one really knows when this will happen, the RBA says growth cannot continue indefinitely and there’s every chance of some correction, especially in some of the overvalued suburbs. This is not intended to frighten anyone. It just pays to get educated. I remember in 1999 to 2003, Sydney was in what people universally agree was a housing bubble. Of course at the time, the ‘experts’ said it wasn’t. From 2003 to 2008, prices fell around 30% across the board, with more affluent suburbs seeing a 50% drop in values. People lost investments and hearts were broken! To add insult to injury, a turn-down often means job losses, which further increases people’s exposure and risk to meet their debts.

Granny Flats – Your Insurance Against Bankruptcy

I think most of you would already sense where I’m heading here. Banks take away properties from people who can’t service their loan. It’s as simple as that. Many mum and dad investors simply can’t cover their shortfall, especially as interest rates go up, jobs are lost and/or property values slump. They’re actually then stuck with a property they cannot sell and the debt just keeps on climbing. It’s disastrous. Your real estate agent won’t care when you go to sell because he made $20,000 on your purchase last year and will rightly look at buying your property for himself now. I’m not trying to be funny here. This is why a lot of agents buy property after a huge fall, and so should you!

Granny Flats Save The Day, And Your Future!

A granny flat does something no property-investment spruiker will ever tell you. ‘Property Gurus’ just want you to keep buying property as soon as you possibly can and to keep on duplicating. This is ok during a growth cycle but absolutely disastrous during a slump. The risk is actually compounded the more properties you leverage. This is a fact and no seminar junky gets to hear about this scenario.

So what does a granny flat do and how does it do it? Let’s again take the example above:

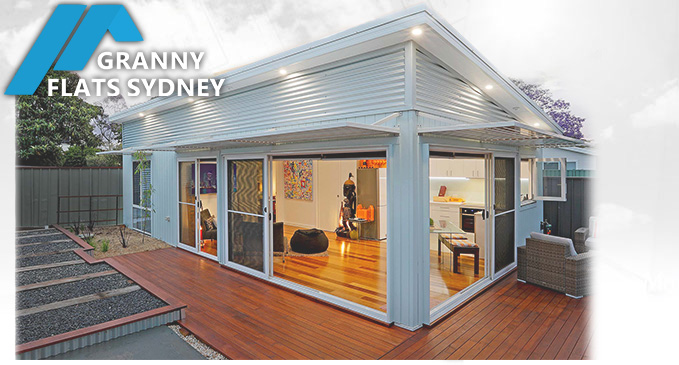

Immediately after the purchase (if not during settlement), you get a granny flat approval and build done. Actually, even before you buy that property, enlist the help of an experienced granny flat design and approval guru (yours truly if you don’t mind the plug!) so that he/she can check the property for suitability. Now, back to our example. You build a granny flat for $100,000 and now your mortgaged for $1.1M which means repayments of $1,050 per week. Now this is where the magic happens. Your rental income is $630 (reduce $30 for loss of yard) and the granny flat will earn around $450 = $1,080 per week. As you can see, you are now neutrally geared, if not positively geared on your property investment. You are now protected and your risk is hugely diminished. This is the beauty of granny flats. I stress again that it pays to get the right person to advise you on the suitability of that property. Hugely important!

Below I have listed some current (October 2014) client’s position on their property investment. All of them have granny flats of course and all of our clients have taken the time to build a granny flat before moving onto their second, third and fourth investment property. So here are some interesting figures:

You can click on the table above to expand it. As you can see, adding a granny flat has provided a hugely beneficial safety-net to these properties. There’s also the benefit of having the banks love you because you’re not negatively geared. So you can easily traverse from one property to the next with confidence. We can’t ask for better than that.

When interest rates begin to move again (and they will), will your investment be protected? Will you be one of the smart investors who took steps, while they had access to borrowings so that you can quickly (takes only 12 weeks max) build a granny flat and PROTECT YOUR INVESTMENT?

FINAL CRITICAL NOTE: Its vitally important to find, design, approve and build a Granny Flat which is well situated to maximise your rental returns. We talk A LOT about smart property choices in our Happy Hunting Guides, so be sure to check out our Pricing Guides. We have many guides and articles on this website to help you with these decisions and we offer a comprehensive building experience which supports investors during ALL aspects of your proposal. We even offer a Granny Flat Buyer’s Agent Service which finds properties for you, which are perfect for maximising rental returns and capital growth.

Feel free to call me to begin the most important property investment strategy of your (and your family’s) future.

Warm Regards,

Serge Panayi.

1300 205 007

2 replies on Protecting Your Investment – Granny Flat Strategies

Hi,

My wife and I purchased a 4 bedroom house near the university. The back bedroom already Had its own existing bathroom and large 3×2.8m walk in wardrobe. So, given we live close to the university I put a small kitchenette in the wardrobe room consisting of a sink and cupboards (all appliances including oven are portable small plug in type). I changed the window in the wardrobe to a double entry door but left the internal door to the rest of the house from the bedroom in place…

It wasn’t until recent that I cAme to the realisation that council approval should have been soughted which I’m happy to pursue.. However after reading about fireproofing you could say I’m worried as this would be impossible/ not viable… Soooo……. I wonder

A) if the bedroom, bathroom and kitchennette room is classified as a “granny flat” seeing it is not “self enclosed”. and b) if the kitchen from a technical level would no longer be s kitchen if just cupboards and a sink is left thus the room is albeit the same as the way it wAs with just a sink (if that makes sense)..,,,, I guess I just don’t want to have to remove the whole kitchen or replace the doors with bricks and a window..

Happy to pay for your service and hope you can assist.. Daniel

Hi Daniel,

It’s not difficult to effectively ‘decommission’ the existing (allegedly illegal) Granny Flat. You just need to disconnect any hard-wired cooking facilities, including any gas connections. A truly legal Granny Flat will require a fire rated wall in order to comply with the Building Code of Australia (Part 3.7.1). It must be sealed from the main part of the dwelling in all 3x dimensions (floor/walls/roof). We can get the approval for you but you wont be able to ‘occupy’ it until the fire-rated work is completed by a builder and inspected by a Certifier or Council – sorry!