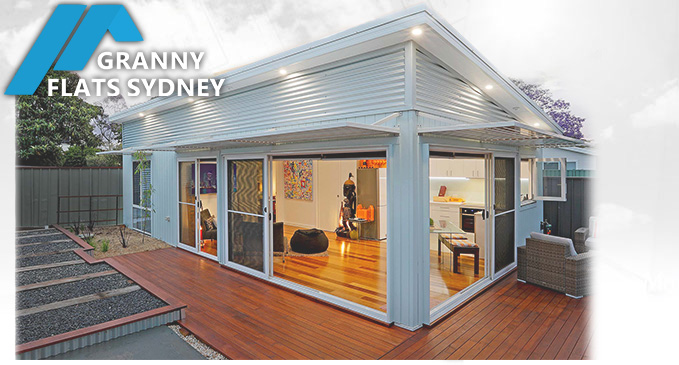

How to secure a Granny Flat Construction Loan

Construction of new granny flats is now on the rise as homeowners and investors begin to realise that capitalising on their existing real-estate asset is a very smart move, especially now that Sydney (and greater NSW) is facing a long-term rental shortage. There’s also the advantage of not being hit with Office of State Revenue fees-(Stamp Duty and the like).The mathematics is quite simple really- reduce your property’s liabilities and increase it’s earnings. This is what we call positive ROI, or positive return on investment. So how can you secure your granny flat construction loan?

The first and easiest way to secure funds for your new granny flat is via a ‘Line of Credit or ‘Redraw’ on your existing loan, in which you borrow on the ‘equity’ of the property. This simply means if your property’s value is higher than the amount owed, you can borrow on the equity held on the property. For example if you owe $150,000 on a property valued at $400,000, you hold $250,000 equity on the property. A granny flat costing $95,000 would be financed through this equity.

If you don’t have sufficient equity or you don’t wish to apply for a re-draw, the next most popular type of loan is the ‘Construction Loan’. This type of loan differs from a classic Mortgage Loan in that you use the value of the existing property and the proposed construction work as security against the loan.

Application for Finance:

Getting approval for the Construction Loan is a process whereby you must present the lender with two essential documents as part of your application for approval:

- Your Granny Flat Approval

- Your Builder’s Contract

Lets quickly take a look at where you can reduce the costs associated with financing your new secondary dwelling, It does pays to do the research and there are definitely ways to minimise these costs as they relate to:

- The Property Valuation

- Your Home Loan Establishment Fees

- Your Granny Flat Approval

- The Construction of the Granny Flat

When you approach your lender for pre-approval, they’re going to carry out a Property Valuation. You should look for a lender that doesn’t charge for the valuation or a lender that refunds the fee should you get approval.

You should also ask about the Loan Establishment fees and any other charges. Compare these against other lenders and haggle on these fees.

A compulsory requirement before finance is finally granted is the Granny Flat Approval, from either a Private Certifier or the Local Council in NSW. We advise our clients to look for a granny flat designer who is experienced and is keenly intimate with the current NSW SEPP Legislation. This is to ensure you cross the bridge between design and final approval as seamlessly, cheaply and quickly as possible. It stands to reason that the experts are those who deal with approvals every single day. The SEPP Legislation can and certainly does change without notice, so it definitely pays to get advice from the people who deal with the legislation day in, day out.

The Building Contract is the final and critical document which must be carefully selected prior to loan approval. The Building Contract is a legally binding document which should be prepared by a Licensed Builder using the Department of Fair Trading’s template for building contracts. The granny flat project should also be secured via ‘Home Warranty Insurance’. Fortunately, your lender won’t release finance without this, so you can be assured of this protection as well.

So to recap, you will need the Approval and the Building Contract. Without these, the lender will not approve the construction loan

Choosing the right Builder:

Once you have your Granny Flat Approval and the Contract is signed, the Lender will approve the Construction Loan. We always advise you to look at the builder’s previous work and talk to their recent clients as well. View the builder’s previous work and talk to the Builder’s recent clients to get their feedback. Be sure to ask:

- Did the builder complete the work on time?

- Did the builder communicate effectively and was he professional in his approach to building?

- Did the quality of the work satisfy the client?

- What, if any, difficulties did the project have and what did the builder do toy rectify these issues?

- Did the builder stick to the contract?

- Would they recommend the builder to others or no?

The Building Payments:

Once the construction begins, the construction loan is usually paid in monthly installments. The lender will send out a Loan-Assessor who will complete a checklist before signing off on each stage. This is designed to protect you and ensure the builder is holding to his part of the agreement- ‘The Building Contract’. You can generally make additional repayments during the construction phase but these additional payments cannot be redrawn. Once construction is completed and the Certifier issues the ‘Occupation Certificate’ the Construction Loan will be reverted to a Standard Loan with all of the usual bells and whistles such as redraw and so on being made available on the loan.

TIP- Demand Turn-Key Pricing!:

Finally, we would remind you to demand ‘TURN-KEY BUILD PRICING’ from your Granny Flat Builder, especially if your’re a landlord. You don’t want to be burdened with having to install the oddities, like clothes-lines, TV Antennas and the like because this time lost is better spent renting out your granny flat sooner. It’s worth considering that, as an investor, time lost procuring inclusions could be time that tenants are occupying and paying rent directly to you.

We hope this guide helps you to understand the process of attaining a construction loan for a granny flat, backyard cabin, studio and the like. We also invite you to browse through our many guides and articles on this website which are written to help you save time and money on your next granny flat building project.

Warm Regards,

Serge Panayi (Granny Flats Sydney).

www.grannyflatapprovals.com.au

2 replies on How to secure a Granny Flat Construction Loan

Hi, would the valuation increase with the addition of a granny flat? If so, from your experience by how much?

Thanks

Hi Waz,

Good quesion. The net value of the property will definitely increase when you have an approved ‘secondary dwelling’ added to a property. The ‘how much’ depends on the suburb and average property valuations in your area. If the property is already valued at or near the maximum for your area, it may only increase by 60% of the construction cost. The data on how much property values are increased for each suburb has not been published by any of the databases that I know of.

As granny flats become more prominent you will see more accurate prices being published as well.

Serge.